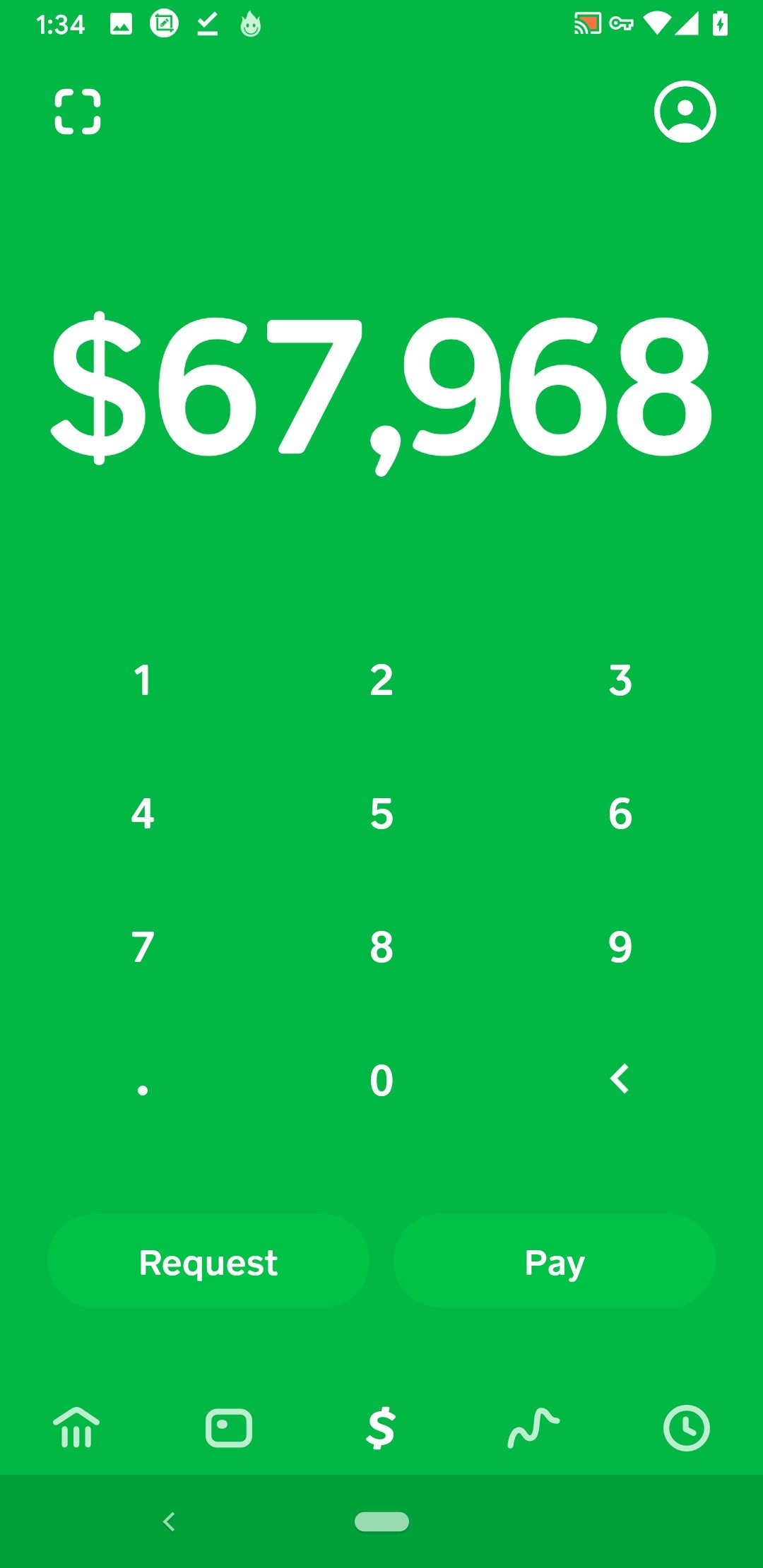

Split Your Money into Manageable Pots in Your Banking AppĪpps are constantly being upgraded with fantastic new features, so, another way mobile banking can help stop spending money is by splitting your money into a different account. This feature has been designed to bring you back down to earth and prevent you from draining your account balance, so you still have enough funds to see yourself through until your next payday. This handy feature will ping you when your balance reaches a low point that you set. If you’re prone to overspending when you travel or go shopping, consider adding a balance alert via your mobile banking app. Set Balance Alerts to Track Your Spending At the very least, you can check your balance before you walk into the next shop, which may jolt you back to reality when you realize you’ve done enough shopping for one day. Mobile banking apps make it possible to check our balances from your smartphones, so if you’re on a shopping spree, check your balances frequently to ensure you don’t overspend. It’s good because we don’t have to carry loads of cash with us, but bad because we often don’t realise how much we’ve spent until the bank statement is issued.

Credit and debit cards with Point-Of-Sale devices mean we can shop with the funds coming directly from our accounts. When the money ran out, it was time to go home. Most people took a set amount of cash out of their bank account, and they shopped with just that. Once upon a time, the only way to shop was with cash in your wallet. You may be wondering, “How can mobile banking help you to stop spending money?” Believe it or not, it’s a lot easier than you may think. The key to reigning in on your spending is to know where your money is going, and one of the best tools at your disposal is a mobile banking app. Sometimes the items we purchase are essential, and other times, we probably could have waited before succumbing to our impulses. One thing we humans seem to be really good at is overspending.

0 kommentar(er)

0 kommentar(er)